Effectively managing finances is crucial to the success of any property investment. With the right accounting software, you can streamline tasks, reduce stress and make informed decisions.

But with so many options available, choosing the best property accounting software can be challenging. In this post, we will explore the top 4 property accounting solutions that are revolutionising the way investors, property managers and mortgage brokers handle their finances. Let's get started.

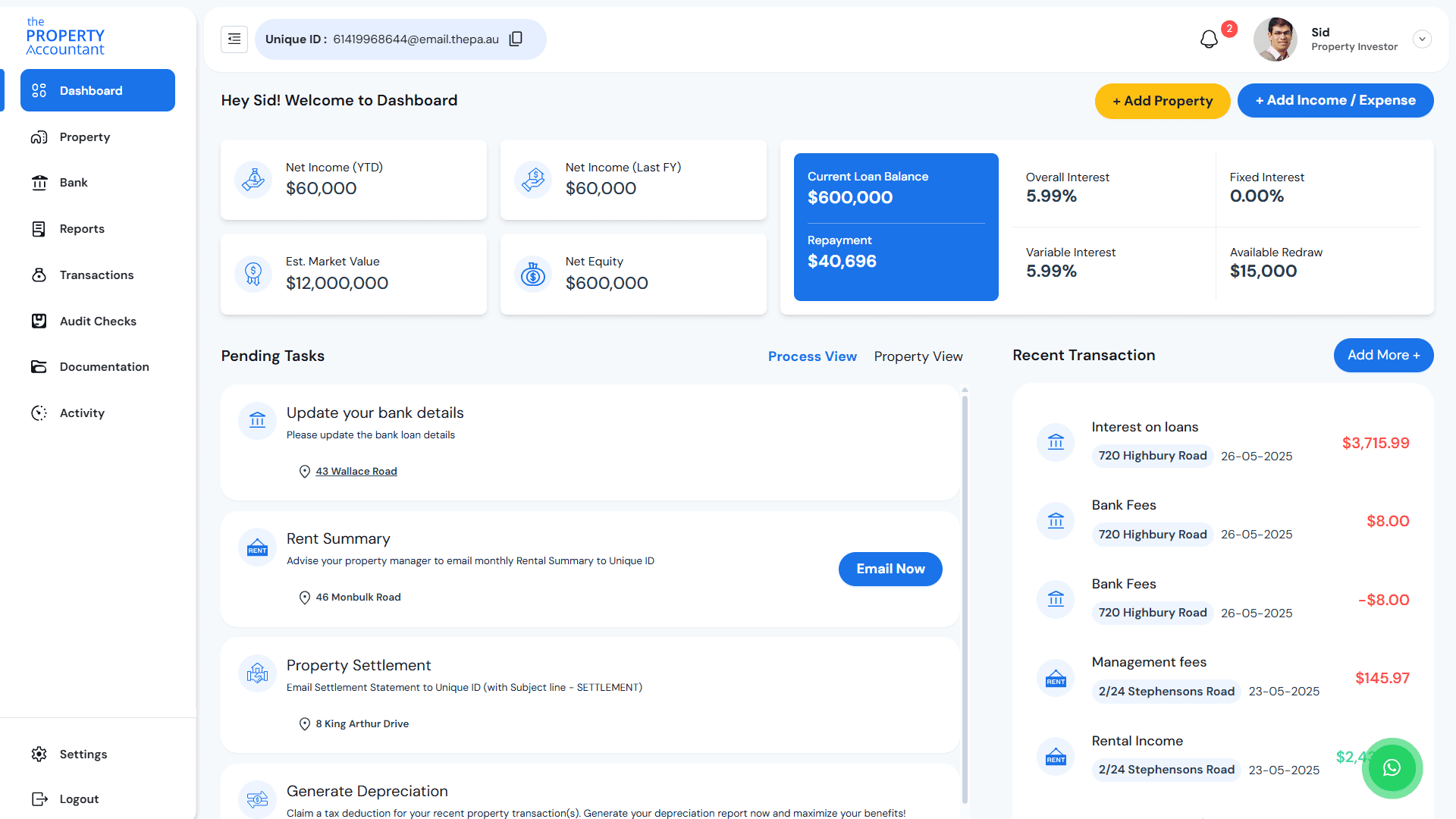

The Property Accountant is an all-in-one accounting software designed to streamline accounting and financial management for property investors in Australia. It is accessible as both a web and mobile application, providing a solution for property investors , tax accountants and mortgage brokers to effectively manage the accounting and finance needs of their investment portfolios.

PropertyMe is a cloud-based property management software for property managers and real estate companies offering property management services. It offers live bank feeds, reconciliation, trust accounting and automated fee management. PropertyMe also provides property managers with a tenant portal for online payments and maintenance requests.

Google Sheets and Excel are general-purpose applications that can be used for basic property accounting and investment tracking. While they lack the specialised features and automation of dedicated property accounting software, these widely-used spreadsheet tools can still be a viable option for very small-scale landlords and investors.

Xero is a popular cloud-based accounting software that offers a range of features for property management. It includes automated bank feeds, rent tracking, trust accounting and comprehensive reporting. Xero also integrates with various property management platforms, making it a versatile choice for real estate professionals.

Selecting the right property accounting software is essential for managing your investment portfolio effectively. Each of the four solutions we've reviewed offers unique benefits:

Consider your portfolio size, technical expertise, and specific needs when making your choice. For most Australian property investors, The Property Accountant offers the best balance of features, automation, and value.