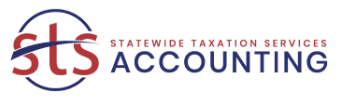

The All-in-One Solution forProperty Investors. Tax Accountants. Mortgage Brokers

Simplify Accounting, Streamline Finances and Manage Documents

Manage Property Income, Expenses, Loans and Tax Reports with our Mobile App and Web Portal. Collaborate with Mortgage Brokers and Tax Accountants through one-click access

For Property Investors, Tax Accountants and Mortgage Brokers

Solution Tailored to save time, reduce stress and maximize results for every property professional

Property Investor

Simplified Property Accounting & Finances

Automate income, expense and cost base tracking, gain real-time insights, and generate reports effortlessly—all in just 5 minutes a month.

Learn MoreTax Accountant

Streamline Property Tax Finalisation

Easily access client property income, cost base, loan statements and tax papers—no emails, spreadsheets, or manual data compilation

Learn More

Mortgage Broker

Boost Client Retention & Referrals

Deliver unparalleled client service with real-time insights—streamline rate repricing, secure the best loan deals and easily access loan data for new applications

Learn MoreAutomate, Analyze and Grow

Property Accounting and Finances Reimagined

How We Manage Data From Various Sources

1. Settlement Statement

Email statement for auto update

2. Depreciation Schedule

Email schedule for auto update

3. Bank Loans

Connect live feed from 100+ banks

4. Monthly Rent Statement

Email statement for auto update

5. Expenses directly paid

Update via mobile app or web portal in seconds

Property Investor

View income, market value, loan balance, net equity and interest rate of your property portfolio in real time.

Track income, expenses and costs in less than 5 minutes a month.

Generate tax reports and analytics instantly for smarter decision-making.

Organize financial and store key documents to simplify property management.

- •Easily access client property data through a dedicated portal.

- •Eliminate back-and-forth emails and manual data collection.

- •Review and finalize property tax reports in minutes.

- •Download reports, supporting documents, loan statements, and tax work papers instantly.

- •Access real-time property data, loan details, interest rates, and repayments across banks.

- •Compare options and simplify repricing, refinancing, and new loan applications.

- •Eliminate manual follow-ups with real-time access to loan summary and bank statements.

- •Deliver standout service that drives retention, referrals, and long-term client value.

Your 5-Minute Path to Perfect Property Records

Designed to Save Time, Reduce Stress and Maximize Returns and See How It Works!

1. Add Your Property Profile

Set up your property in minutes

Address • Property type & Structure • Loans details

• Depreciation

2. Connect Bank Loans

Securely connect loans from 100+ banks via Open Banking for automatic updates

3. Email Documents to Unique ID

Email your settlement and depreciation documents securely.

6. Get Real Time Insights

Track income, value, loans, equity, and interest rates in real time.

5. Expenses Directly Paid by You

Upload expenses paid by you and keep everything organized in one place.

4. Advise Your Property Manager

Ask your property manager to send monthly rental summaries to your unique ID.

1. Add Your Property Profile

Set up your property in minutes

Address • Property type & Structure • Loans details

• Depreciation

2. Connect Bank Loans

Securely connect loans from 100+ banks via Open Banking for automatic updates

4. Advise Your Property Manager

Ask your property manager to send monthly rental summaries to your unique ID.

3. Email Documents to Unique ID

Email your settlement and depreciation documents securely.

5. Expenses Directly Paid by You

Upload expenses paid by you and keep everything organized in one place.

6. Get Real Time Insights

Track income, value, loans, equity, and interest rates in real time.

Making Property Finances Effortless for Everyone

See how investors, accountants, brokers and buyers advocates benefit. Join thousands simplifying property finances.

Built on Trust, Committed to Security

ISO 27001 certified—we follow best practices to ensure top-tier security and privacy.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Compliant Banking Integration

Adheres to ACCC regulations.

Compliant Banking Integration

Adheres to ACCC regulations.

Compliant Banking Integration

Adheres to ACCC regulations.

Multi-Factor Authentication

Mandatory at all levels for security.

Multi-Factor Authentication

Mandatory at all levels for security.

Multi-Factor Authentication

Mandatory at all levels for security.

Protected Data Storage

Encrypted at rest by Amazon

Protected Data Storage

Encrypted at rest by Amazon

Protected Data Storage

Encrypted at rest by Amazon

Robust Password Management

Powered by Amazon Cognito

Robust Password Management

Powered by Amazon Cognito

Robust Password Management

Powered by Amazon Cognito

Connect with 100+ Banks & Lenders – Secure & Automated

Securely connect live feeds from 100+ banks and lenders via Open Banking (Consumer Data Rights), ensuring privacy, security and real-time financial insights.

Connect with 100+ Banks & Lenders – Secure & Automated

Seamless Open Banking connectivity for automatic Loan Account feeds—no online banking passwords required.

Begin Your Digital Transformation

Take the first step towards streamlining your property accounting, finances and document management with our AI-powered tools.