As a property investor managing multiple properties, I know how crucial it is to have the right accounting, finance and document management process and tools.

Over the past three months, I've tested many different platforms to find solutions that actually work for Australian property investors, tax accountants and mortgage brokers. Based on my review and experience as property investor I've narrowed it down to the top 6 platforms that delivers may work for you truly deliver. Let's explore which ones are worth your time.

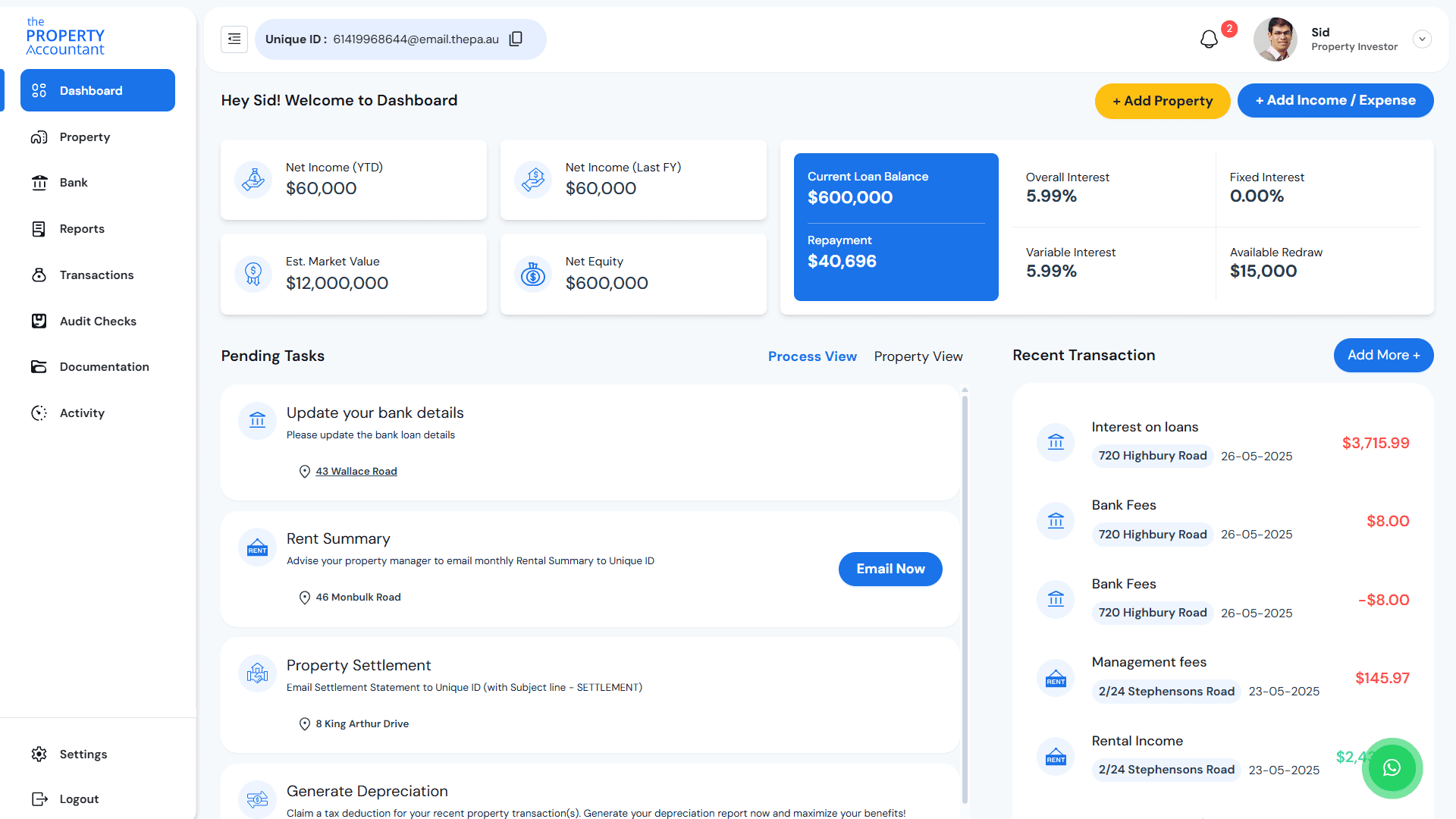

If you're involved in property investment in Australia, you know how challenging it can be to keep track of accounting, finances, documents, and reports. The Property Accountant is a platform that simplifies the financial side of property management. It helps you manage everything from rental income to expenses, making it easier for you to focus on growing your investments and achieving your financial goals.

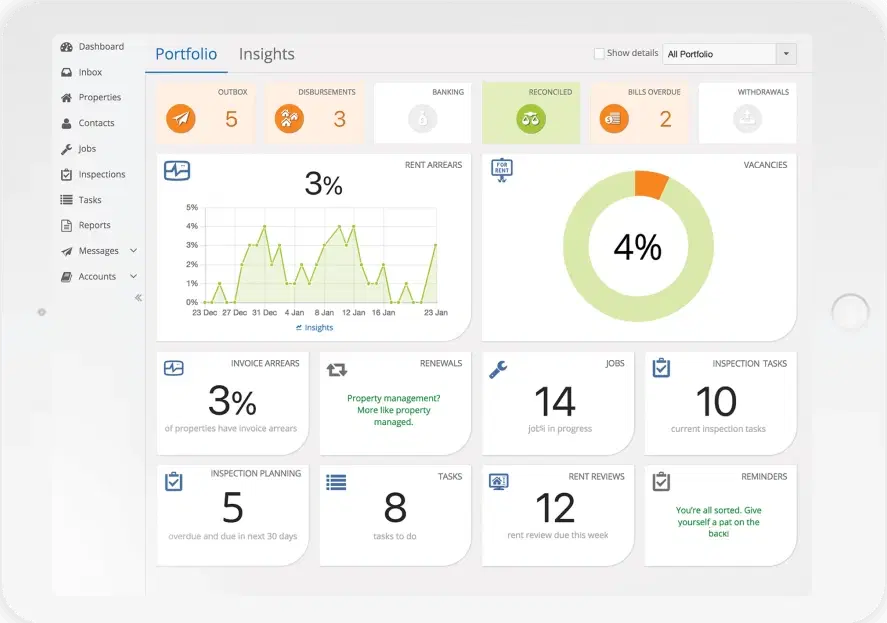

PropertyMe is also one of the most popular property management tools in Australia, catering to agencies and landlords. The platform offers comprehensive trust accounting, maintenance tracking and automated workflows, making it a reliable choice for managing multiple properties efficiently.

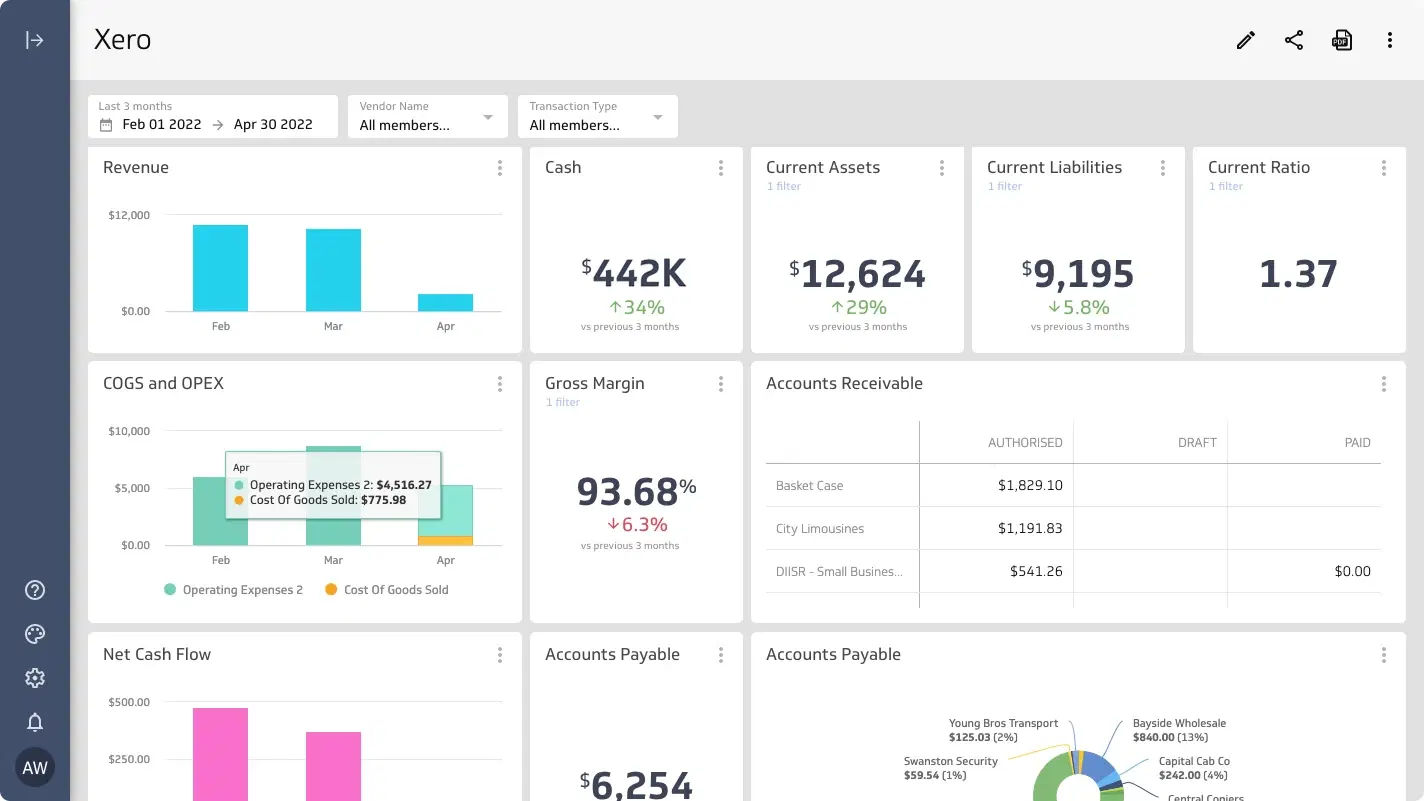

Xero is a popular and widely trusted accounting software that offers robust features suitable for property investors, realtors and real estate accountants. It's known for its flexibility and extensive app ecosystem.

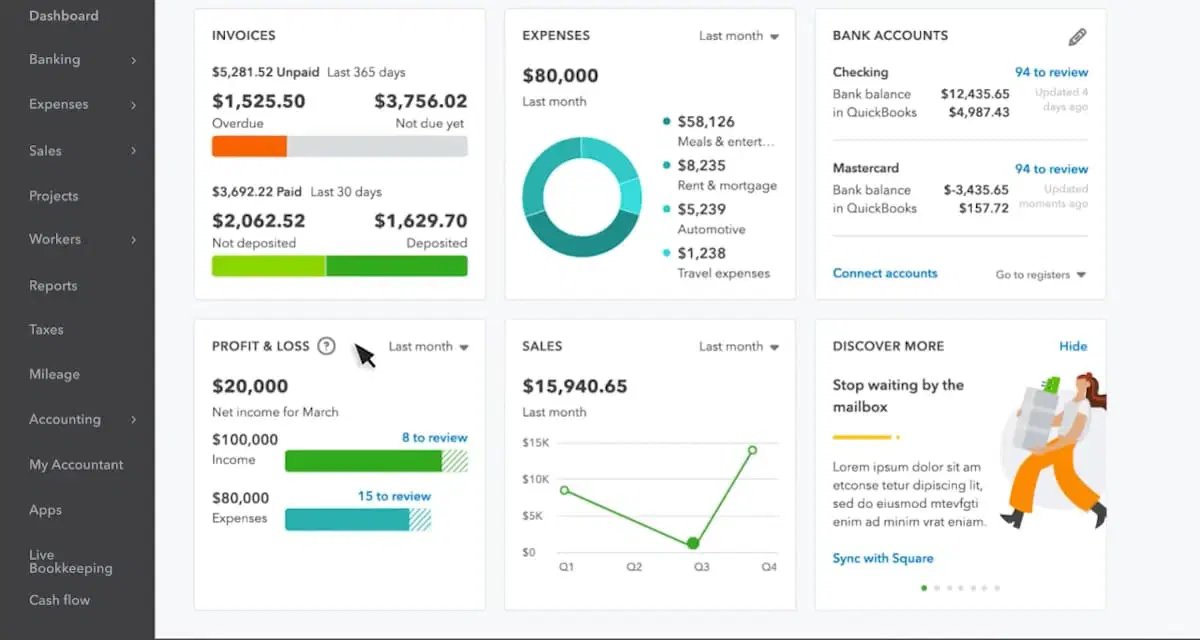

QuickBooks is a well-established accounting software that provides a variety of features for property investors, realtors and real estate accountants. It's particularly strong in financial management and reporting.

PropertyDollar is designed for Australian property investors, providing tools for real-time property value tracking, portfolio management and personalized investment recommendations.

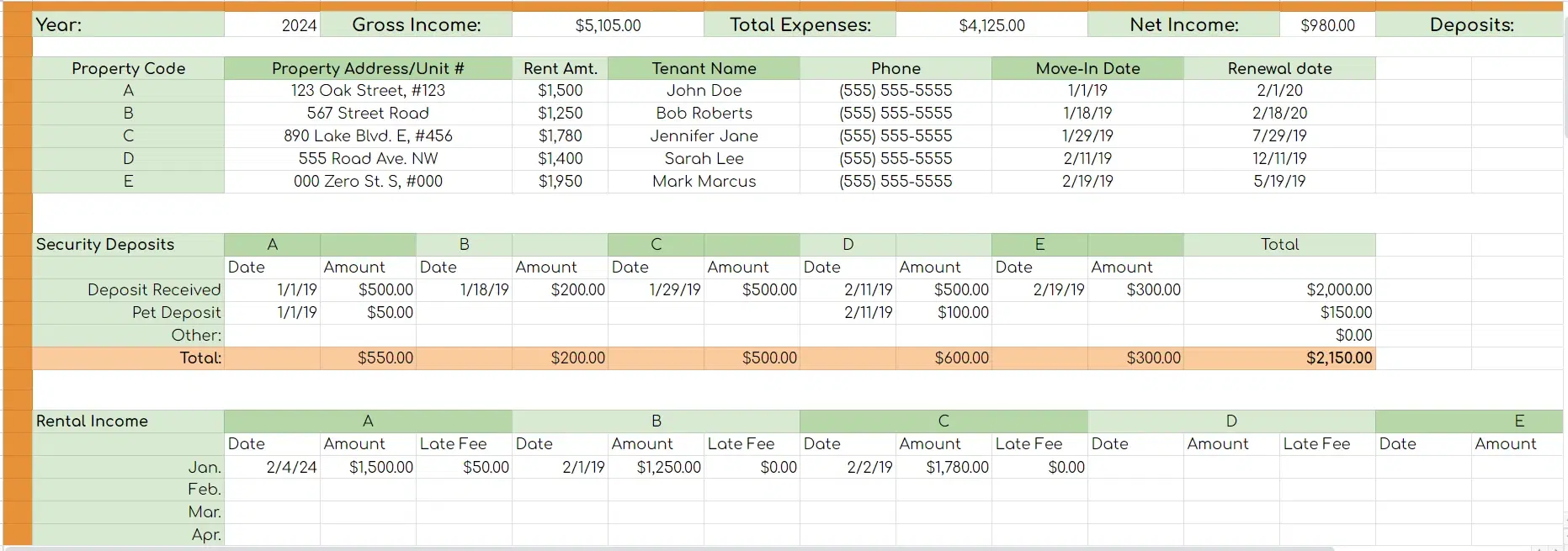

Excel and Google Sheets are basic yet effective tools for property owners who need a low-cost solution. They offer the flexibility to create custom templates for tracking income, expenses and budgets, making them ideal for simple property management tasks.

Choosing the right real estate accounting software depends on your specific needs, portfolio size, and budget. Each of the six solutions we've reviewed offers unique benefits:

For most Australian property investors looking for a dedicated, automated solution, The Property Accountant offers the best balance of features, ease of use, and value. Consider starting with the free trial to see if it meets your needs.