The All-in-One Solution forProperty Investors. Tax Accountants. Mortgage Brokers

Simplify Accounting, Streamline Finances and Manage Documents

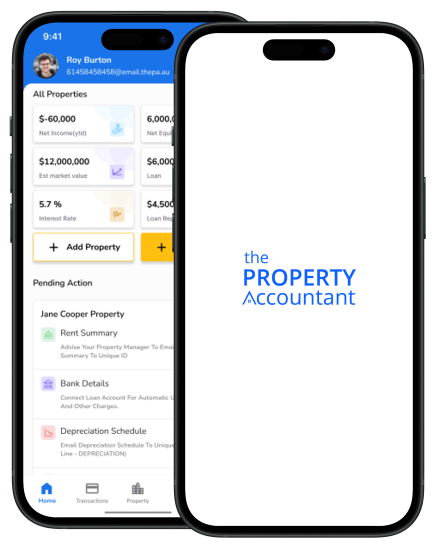

Manage Property Income, Expenses, Loans and Tax Reports with our Mobile App and Web Portal. Collaborate with Mortgage Brokers and Tax Accountants through one-click access

For Property Investors, Tax Accountants and Mortgage Brokers

Solution Tailored to save time, reduce stress and maximize results for every property professional

Property Investor

Simplified Property Accounting & Finances

Automate income, expense and cost base tracking, gain real-time insights, and generate reports effortlessly—all in just 5 minutes a month.

Learn MoreTax Accountant

Streamline Property Tax Finalisation

Easily access client property income, cost base, loan statements and tax papers—no emails, spreadsheets, or manual data compilation

Learn More

Mortgage Broker

Boost Client Retention & Referrals

Deliver unparalleled client service with real-time insights—streamline rate repricing, secure the best loan deals and easily access loan data for new applications

Learn MoreAutomate, Analyze and Grow

Property Accounting and Finances Reimagined

How We Manage Data From Various Sources

1. Settlement Statement

Email statement for auto update

2. Depreciation Schedule

Email schedule for auto update

3. Bank Loans

Connect live feed from 100+ banks

4. Monthly Rent Statement

Email statement for auto update

5. Expenses directly paid

Update via mobile app or web portal in seconds

Property Investor

View income, market value, loan balance, net equity and interest rate of your property portfolio in real time.

Track income, expenses and costs in less than 5 minutes a month.

Generate tax reports and analytics instantly for smarter decision-making.

Organize financial and store key documents to simplify property management.

Tax Accountant

- •Easily access client property data through a dedicated portal.

- •Eliminate back-and-forth emails and manual data collection.

- •Review and finalize property tax reports in minutes.

- •Download reports, supporting documents, loan statements, and tax work papers instantly.

Mortgage Broker

- •Access real-time property data, loan details, interest rates, and repayments across banks.

- •Compare options and simplify repricing, refinancing, and new loan applications.

- •Eliminate manual follow-ups with real-time access to loan summary and bank statements.

- •Deliver standout service that drives retention, referrals, and long-term client value.

Your 5-Minute Path to Perfect Property Records

Designed to Save Time, Reduce Stress and Maximize Returns and See How It Works!

1. Add Your Property Profile

One time setup / 1-2 min

Set up your property profile in minutes—just enter the address, type (Residential/Commercial), loan details and depreciation method.

2. Connect Bank Loans

One time setup / 1-2 min

Securely link your loan accounts with 100+ banks using Open Banking (ACCC) for automatic transaction updates.

3. Email Documents to Unique ID

One time setup / 1-2 min

- •Email Settlement Statement (Subject: Settlement)

- •Email Depreciation Schedule (Subject: Depreciation)

4. Advise Your Property Manager

One time setup / 1-2 min

Ask your property manager to send the monthly Rental Summary to your unique ID. You can also forward past rental summaries you've received

5. Expenses Directly Paid by You

On going / 2-3 min

Use our mobile app or website to scan or upload receipts and invoices directly paid by you—keeping everything organized in one place.

6. Get Real Time Insights

On going / 2-3 min

Track Income, Market Value, Loan Balance, Net Equity and Interest Rates of your property portfolio in real time

Making Property Finances Effortless for Everyone

See how investors, accountants, brokers and buyers advocates benefit. Join thousands simplifying property finances.

Built on Trust, Committed to Security

ISO 27001 certified—we follow best practices to ensure top-tier security and privacy.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

ISO/IEC 27001:2022 Certified

Ensuring top-tier security standards.

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Secure Data Transfer

Protected by Cloudflare Pro Firewall

Compliant Banking Integration

Adheres to ACCC regulations.

Compliant Banking Integration

Adheres to ACCC regulations.

Compliant Banking Integration

Adheres to ACCC regulations.

Multi-Factor Authentication

Mandatory at all levels for security.

Multi-Factor Authentication

Mandatory at all levels for security.

Multi-Factor Authentication

Mandatory at all levels for security.

Protected Data Storage

Encrypted at rest by Amazon

Protected Data Storage

Encrypted at rest by Amazon

Protected Data Storage

Encrypted at rest by Amazon

Robust Password Management

Powered by Amazon Cognito

Robust Password Management

Powered by Amazon Cognito

Robust Password Management

Powered by Amazon Cognito

Connect with 100+ Banks & Lenders – Secure & Automated

Securely connect live feeds from 100+ banks and lenders via Open Banking (Consumer Data Rights), ensuring privacy, security and real-time financial insights.

Connect with 100+ Banks & Lenders – Secure & Automated

Seamless Open Banking connectivity for automatic Loan Account feeds—no online banking passwords required.

Begin Your Digital Transformation

Take the first step towards streamlining your property accounting, finances and document management with our AI-powered tools.